The Power of Compound Interest

Written by Andrew Fort

In this article, I would like to explain why it makes sense to invest in shares rather than holding everything in cash. Many people are scared of investing in shares because we know that the value goes down as well as up.

Since 1988 (a 32 year period) the annualised return from global shares has been around 10.5%[1]. Over the same period of time cash gave returns of around 2%.

Cash is guaranteed not to fall in value. The same is not true of shares. Indeed, from November 2007 to October 2008 a global portfolio would have fallen in value by 38%. In other words, £100,000 fell to £62,000. This partly explains the adage that a minimum five year time span should be anticipated whenever investments are made in shares.

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

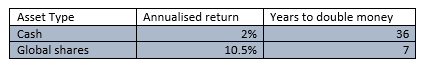

To illustrate this point the table below shows how long it would take to double your money.

To put it another way, £100,000 held in cash would have doubled to £200,000 after 36 years. The same amount of money invested in global shares would have grown to £3,200,000. Such is the power of compound interest. Of course, inflation would have had a significant impact on both numbers.

A sound investment strategy combines many different asset types. Cash should always be a part of an investment strategy, depending partly on an individuals attitude to risk but also on their likely requirements over the next five years. The important point to note is that risk and return are related; they have to be as no one would take additional risk if there wasn’t at least the prospect of greater return.

A sound investment strategy considers many different aspects but in time is one of the most important aspects. The earlier one starts to invest the greater the benefits of compound interest in the long run.

[1] please note that returns vary; over the last 20 years the annualised return was 7.24%

November 2021